Our EVCI Framework recognises different populations within the North will experience the Electric Vehicle transition at a different pace, and will have different charging needs.

To help improve our evidence around this and promote a fairer, better targeted electric vehicle transition, we set out to explore the attitudes of car and van owners among our online research community, Northern Transport Voices.

During this insight series, we will explore user responses in key areas influencing the transition to electric vehicles:

Our Transport Decarbonisation Strategy sets out the decarbonisation trajectory for the North with the aim of reaching a regional near-zero carbon surface transport network by 2045.

The strategy and our enabling Future Travel Scenarios provide the vision and understanding towards the mix of technology, behavioural and place based solutions that is required to reach our decarbonisation targets.

Currently over half of surface transport carbon emissions are generated by cars, and a further 11% by vans. Road transport has a critical role in meeting UK targets for decarbonisation, and one of the central solutions to this will be the need for a rapid rollout of electric vehicle (EV) charging infrastructure. Even with substantial investment in public transport and active travel measures to reduce traffic growth, road transport will remain the dominant mode of travel for longer distance travel across the region. This is why fast and efficient action is required to decarbonise how we use our roads, and this will require integrated planning across energy, spatial and other sectors.

The transition to electric vehicles is steadily gathering pace, with industry showing significant commitment to manufacturing new stock and also boosting the second-hand market. However, in March 2023 plug-in cars (plug-in hybrid electric (PHEV) and battery electric (BEV)) still only accounted for 3.4% of all licensed cars on UK roads, demonstrating there is a long way still to go to fully upgrade the car fleet.

Despite electric vehicles becoming increasingly accessible to more and more consumers, there remain significant barriers to uptake, particularly relating to the comparatively high purchase costs of the vehicles, and limitations of the nascent public charging infrastructure.

Our evidence shows the North is experiencing slower uptake of electric vehicles than nationally, as well as being comparatively slower in development of EV charging infrastructure. To help address this, our Electric Vehicle Charging Infrastructure (EVCI) Framework provides evidence-based analysis of the charge point requirements to meet the needs of all types of places across our region.

More than 200 car or van owners within the Northern Transport Voices community responded to our survey. We also spoke with 15 participants in more detail as part of two focus groups (delivered in collaboration with Atkins). We asked car or van owners a series of questions about their plans to replace their current vehicle, the impact that the cost-of-living crisis may have had on these plans, potential timeframes for switching to hybrid or electric vehicles, as well as some more targeted questions about attitudes to shared residential charging solutions, and shared EV ownership models.

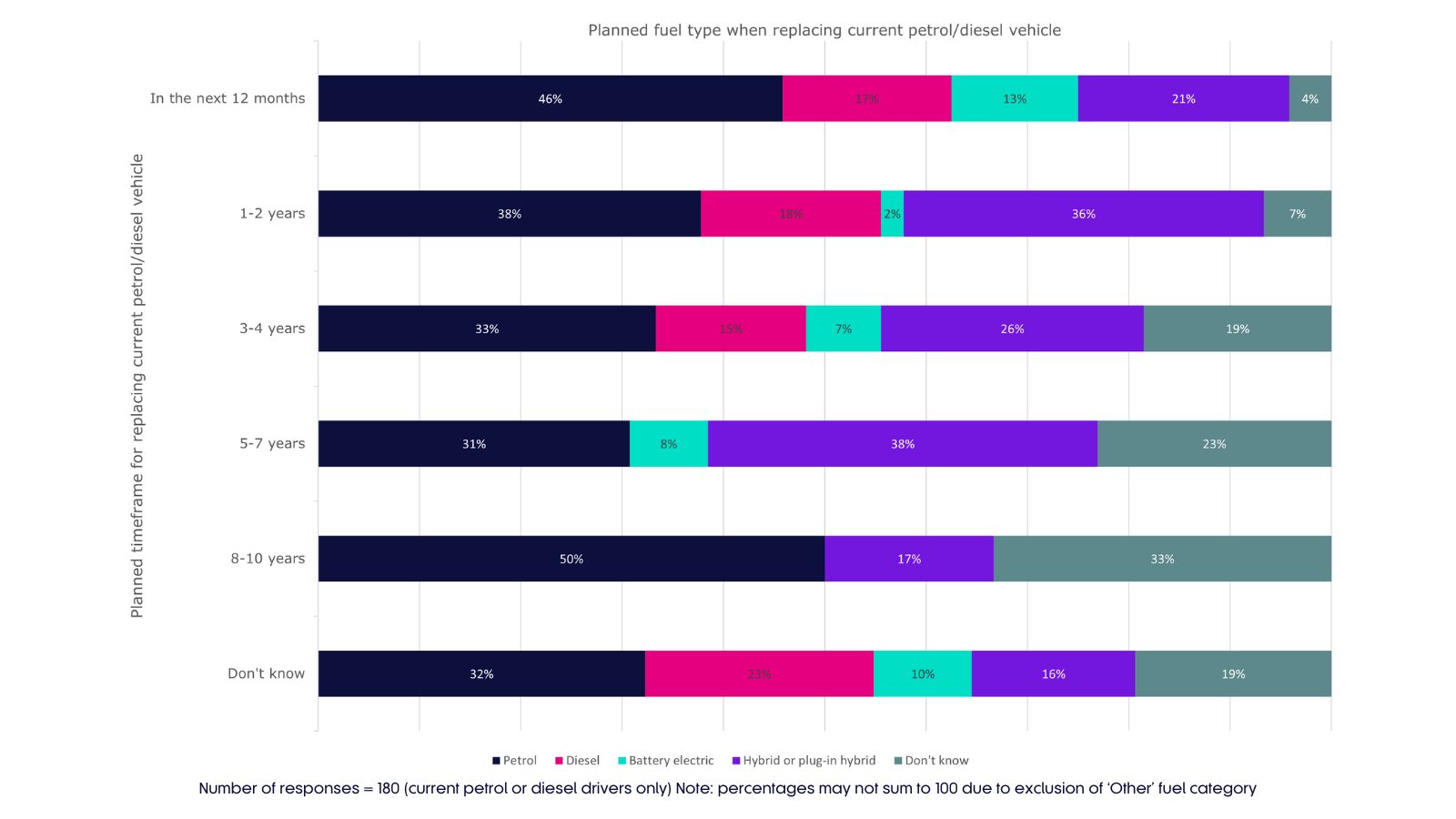

We found 39% of petrol/diesel drivers who responded to our survey plan to replace their current vehicle within the next two years, and a further 15% plan to replace it within the next four years. However, a significant minority (34%) could not identify any timeframe for when they are likely to replace their current vehicle. This shows there is significant potential for motorists who are due to replace their current vehicle to upgrade to hybrid or electric vehicles in the near future. There is also a smaller but notable group of motorists who are much more uncertain around when they would be looking to replace their current vehicle (even though some in this group are driving older vehicles of 10, 15 years or more).

Looking more specifically at which fuel type drivers may choose for their next vehicle, we found that 25% of all current petrol/diesel drivers plan to replace their current vehicle with a hybrid or plug-in hybrid at some point in the future, and a further 7% are interested in switching directly to a BEV (while 15% are still undecided about which fuel type to go for when they replace their current vehicle).

There is quite a bit of variation when it comes to respondents’ potential timeframes for upgrading to hybrid or electric vehicles. The majority of petrol or diesel drivers who responded to our survey do not plan to upgrade in the near future, although they may consider it over a longer timeframe.

What are some of the key issues putting consumers off from upgrading to hybrid and electric vehicles? Despite the cost of such vehicles slowly getting more affordable, these types of vehicles are still out of the price range for many households. This issue has been exacerbated by the cost-of-living crisis.

Our survey found 37% of petrol/diesel drivers who are looking to replace their current vehicle with a hybrid, PHEV or BEV in future said that the cost-of-living crisis had delayed their plans for replacing their vehicle. Overall, the cost-of-living crisis is also having an impact on budget considerations for replacing vehicles, with 56% of survey respondents (driving any vehicle type) saying they will be looking for lower upfront costs and/or lower running costs for their next vehicle compared to previous plans, as a result of the cost-of-living pressures.

At the same time, we also found that for some respondents, the increases in petrol prices have led them to consider switching to hybrid or electric vehicles in the hope of saving money on running costs.

Look out for the next instalment in our Insight series where we will be discussing more of our research findings looking at the barriers consumers are experiencing when considering the switch to hybrid or electric vehicles, including the availability of suitable and convenient charging options.

We will also shine a spotlight on what consumers think about the next big challenge for the public charging infrastructure rollout – shared residential charging solutions (such as kerbside charging points or neighbourhood charging hubs) for drivers who are not able to install private charging points at home.

In the meantime, you can read our report in full below.