Our TAME team has taken a look at the latest UK House Price Index report which has been released by HM Land Registry this week.

The latest house price index data shows a slowdown of house sales across the UK in July 2021, following the end of the Stamp Duty holiday on June 30, 2021.

To keep the housing market moving during the Pandemic, the Government announced that Stamp Duty Land Tax rates on properties worth up to £500,000 would be nil, saving home buyers between 2% and 8% on the cost of purchasing a house, dependent upon price and home ownership status. This became known as the Stamp Duty holiday.

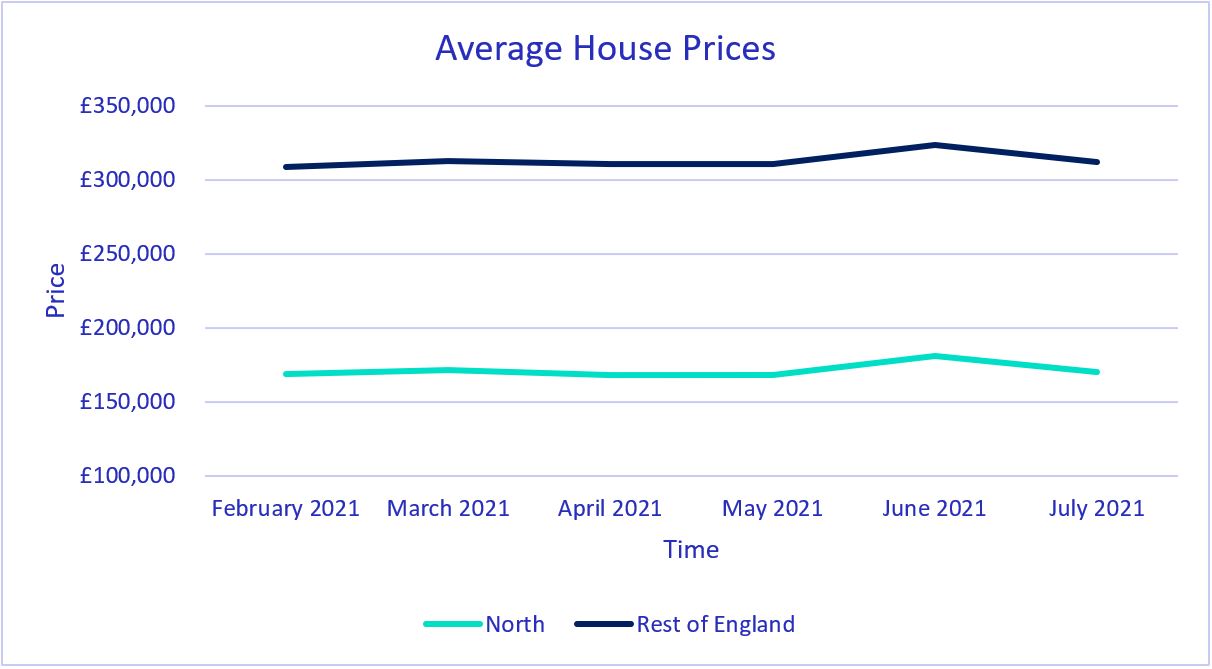

The average house price across the North’s regions in July 2021 was £170,143 down 6.1% on June 2021, just before the Stamp Duty holiday deadline. The average house price in the rest of England was £312,188, down just 3.5% on June 2021. This indicates the reintroduction of Stamp Duty on house purchases over £250,000 has led to a cutting back on the higher-priced homes in the North of England. The decrease is a return to recent trends, both in the North and the rest of England.

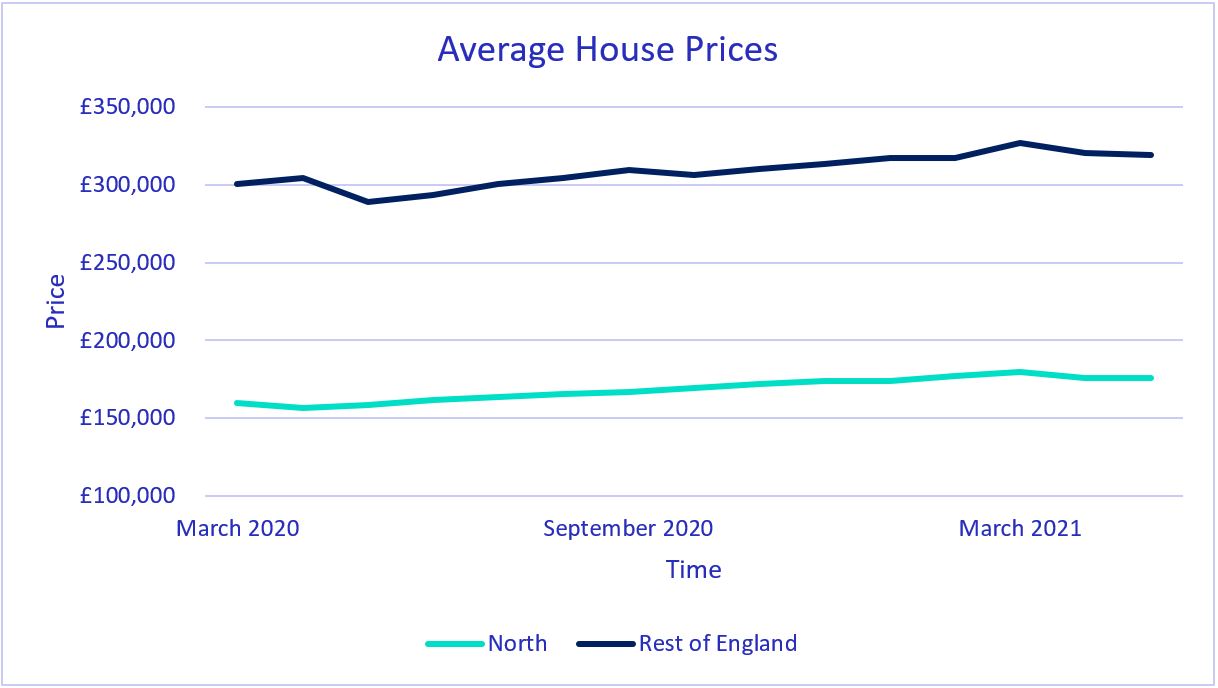

The housing markets of the North and the rest of England have been on an upward trajectory since the beginning of the Pandemic.

In the year leading up to July 2021, average house prices in the North and the rest of England rose by 7.3% and 4.8% respectively. The strength of the North’s increase has been driven by the North East’s rising house prices, where the average house price has risen by 10.8% in the past year.

Whilst the start of the Stamp Duty holiday in June 2020 will have inevitably played a part in this, other factors such as increased household savings and an increase in demand for garden and recreational space in the household will have also driven up house prices.

These factors have led to an ongoing strong demand for houses across most of the UK, against the backdrop of a shortage of houses for sale, which has led to the observed price increase.

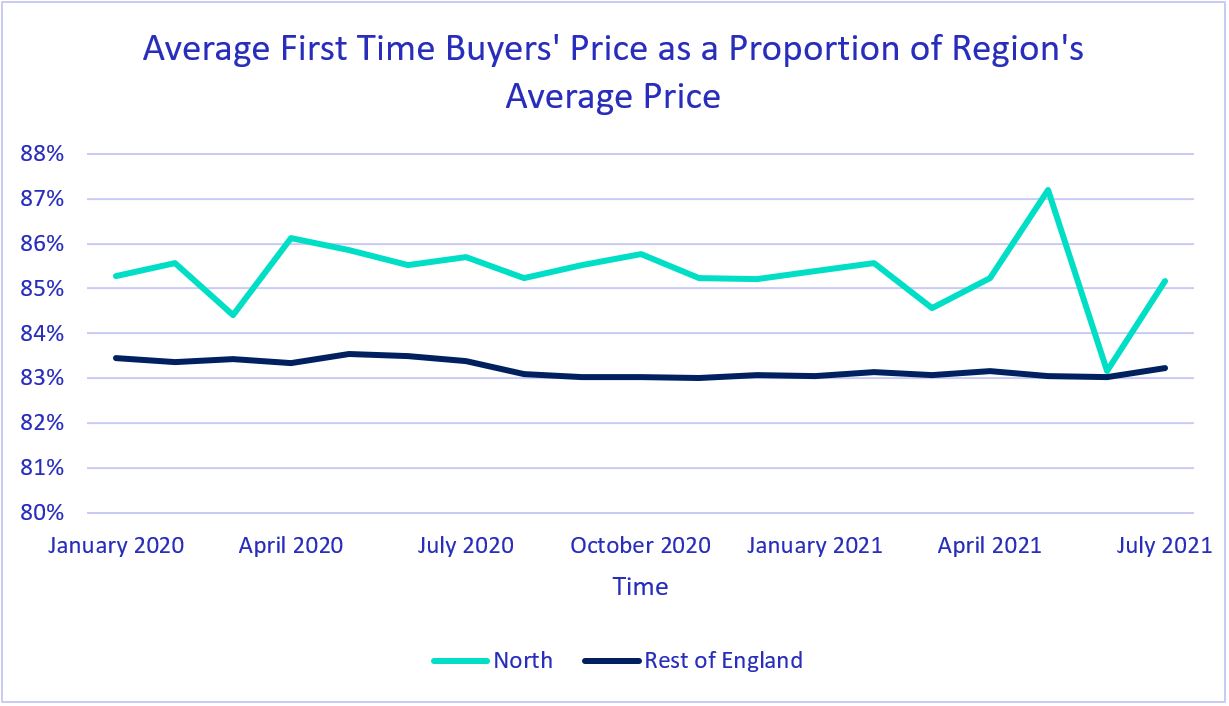

Interestingly, the increase in prices has not diluted the market for first time buyers. Historically, first time buyers in the North pay closer to the region’s average price (85.5% of the average price) than in the rest of England (83.5% of the average price), and this has not changed during the pandemic.

This indicates the North’s housing market provides a relatively better opportunity to buy property as a first time buyer, with first time buyers in the North more able to access the region’s average living standards.

But what does this mean for the North, and why is it important? In 2019, Transport for the North co-funded research by the Institute for Transport Studies at the University of Leeds that revealed a link between transport and property prices.

One study within the report demonstrated significant premiums on house prices as a result of rail accessibility, with an average premium of around 6% on houses that are within 500 metres of a commuter rail station, which are consistent across both higher and lower income areas. This means that improved transport connectivity across the North of England can deliver benefits wider than just improved journey times and cheaper travel costs, enabling all of the North’s citizens to prosper.